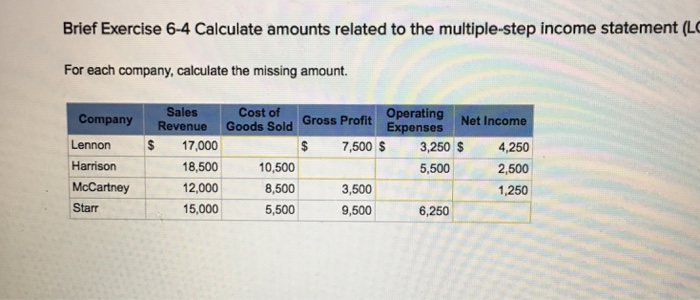

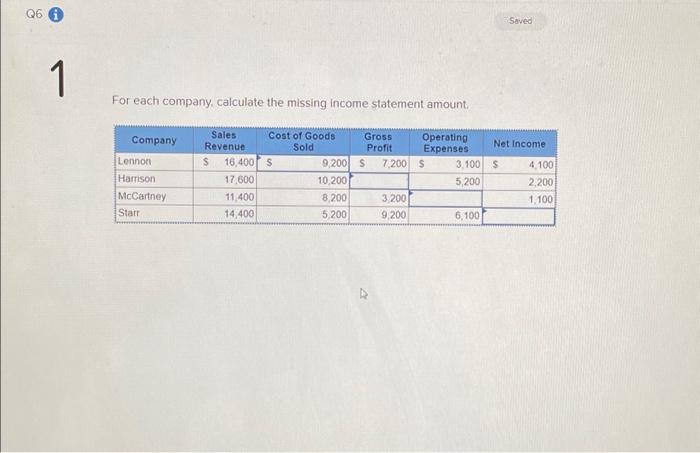

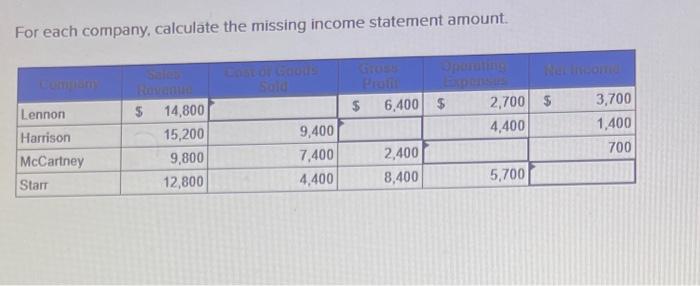

For each company calculate the missing income statement amount – In the realm of financial analysis, missing income statement amounts pose a significant challenge. This guide delves into the intricacies of estimating these missing amounts, exploring the methods, assumptions, and limitations involved. By providing a comprehensive understanding of this critical topic, we empower financial professionals to navigate the complexities of income statement analysis with confidence.

Understanding the components of an income statement, the potential causes of missing data, and the impact on financial analysis is paramount. This guide serves as an invaluable resource for accountants, auditors, and financial analysts seeking to enhance their expertise in this specialized area.

Income Statement Components

An income statement, also known as a profit and loss statement, is a financial statement that summarizes a company’s revenues, expenses, and profits over a specific period of time, typically a quarter or a year. It is one of the three core financial statements, along with the balance sheet and the statement of cash flows.

The income statement is divided into three main sections:

- Operating activities: This section includes revenues from the company’s core operations, as well as expenses related to those operations.

- Investing activities: This section includes gains or losses from the sale of investments, as well as income or expenses from other investing activities.

- Financing activities: This section includes income or expenses from the issuance or repayment of debt or equity, as well as dividends paid to shareholders.

The income statement is an important financial statement because it provides insights into a company’s profitability and financial performance. It can be used to assess a company’s ability to generate profits, as well as its financial health.

Missing Income Statement Amounts

In some cases, income statement amounts may be missing. This can occur for a variety of reasons, including:

- Errors or omissions in the company’s accounting records

- Unusual or complex transactions that are difficult to account for

- Fraud or misstatement of financial information

When income statement amounts are missing, it can make it difficult to assess a company’s financial performance. However, there are a number of methods that can be used to estimate missing income statement amounts.

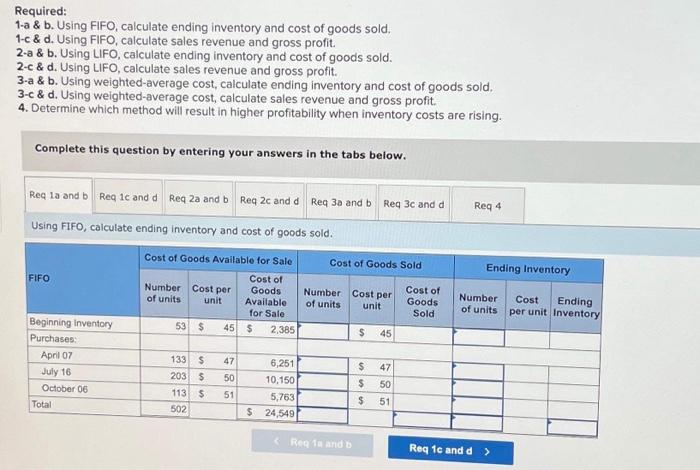

Estimation Methods

There are a number of different methods that can be used to estimate missing income statement amounts. The most common methods include:

- Trend analysis:This method involves using historical financial data to estimate missing income statement amounts. For example, if a company’s revenue has been growing at a steady rate, it may be possible to estimate missing revenue amounts by extrapolating the historical trend.

- Ratio analysis:This method involves using financial ratios to estimate missing income statement amounts. For example, if a company’s gross profit margin has been relatively stable, it may be possible to estimate missing gross profit amounts by multiplying the company’s revenue by the historical gross profit margin.

- Industry averages:This method involves using industry averages to estimate missing income statement amounts. For example, if a company’s industry has an average net profit margin of 10%, it may be possible to estimate the company’s missing net profit amount by multiplying the company’s revenue by 10%.

The choice of estimation method will depend on the specific circumstances and the availability of data.

Assumptions and Limitations

When estimating missing income statement amounts, it is important to be aware of the assumptions and limitations of the estimation methods. For example, trend analysis assumes that historical trends will continue into the future. However, this assumption may not be valid if there are significant changes in the company’s business or industry.

It is also important to consider the materiality of the missing income statement amounts. If the missing amounts are small, they may not have a significant impact on the company’s financial statements. However, if the missing amounts are large, they could have a material impact on the company’s financial performance.

Impact on Financial Analysis: For Each Company Calculate The Missing Income Statement Amount

Missing income statement amounts can have a significant impact on financial analysis. For example, if a company’s revenue is understated, it may appear to be more profitable than it actually is. This could lead to investors making incorrect investment decisions.

It is important to be aware of the potential impact of missing income statement amounts when conducting financial analysis. If there are any missing amounts, it is important to estimate them using a reasonable method and to disclose the assumptions and limitations of the estimation method.

Disclosure and Transparency

It is important for companies to disclose any missing income statement amounts and the methods used to estimate them. This disclosure should be made in the company’s financial statements and in any other public filings.

Auditors play an important role in ensuring the accuracy and transparency of income statement disclosures. Auditors are responsible for reviewing a company’s financial statements and ensuring that they are prepared in accordance with applicable accounting standards.

Best practices for disclosing missing income statement data include:

- Disclosing the amount of the missing data

- Describing the methods used to estimate the missing data

- Explaining the assumptions and limitations of the estimation methods

Case Studies and Examples

There are a number of case studies and examples of companies that have experienced missing income statement amounts. One example is the case of Enron Corporation. Enron was a large energy company that filed for bankruptcy in 2001. The company’s financial statements were found to contain a number of missing income statement amounts, which were used to inflate the company’s profits.

Another example is the case of WorldCom. WorldCom was a large telecommunications company that filed for bankruptcy in 2002. The company’s financial statements were found to contain a number of missing income statement amounts, which were used to hide the company’s losses.

These case studies highlight the importance of disclosing missing income statement amounts and the methods used to estimate them. It is also important for investors to be aware of the potential impact of missing income statement amounts when making investment decisions.

Common Queries

What are the common methods for estimating missing income statement amounts?

Common methods include trend analysis, comparative analysis, and ratio analysis. Each method has its advantages and disadvantages, and the choice of method depends on the specific circumstances.

What are the key assumptions that must be made when estimating missing income statement amounts?

Assumptions include the stability of relationships between financial variables, the representativeness of historical data, and the absence of material changes in the company’s operating environment.

How can missing income statement amounts impact financial analysis?

Missing data can distort financial ratios and other metrics, leading to inaccurate conclusions. It is important to adjust for missing data when conducting financial analysis to ensure reliable results.